Home EquityUse the equity in your home to help pay for your next large purchase or upcoming expense like home improvement projects, child's college or wedding expenses, dream vacation or consolidate credit card debt. |

|

|

Home Equity Line of Credit

|

Get the cash you need to help reach your life goals.

Make home improvements or repairs | Put in a new pool, deck, or roof

Take a dream vacation | Pay for college or wedding expenses

Refinance your mortgage | Consolidate credit card debt

Choose the plan that's best for you.

| Loan Type | Home Equity Lines of Credit (HELOC) | Home Equity Loan |

|---|---|---|

| Features | Get pre-approved for a certain amount with just one application to complete and it serves as a reusable credit line. | Receive the entire amount all at once. |

| Interest Rate | Variable Rate

with the ability to convert a portion of your line into a fixed-rate loan with our RateLock Option4. |

Fixed Rate Lock in your rate and monthly payment amount. |

| Access to Funds |

Withdraw money as you need it Electronically transfer your available funds from your HELOC directly to your checking or savings account. |

Get the money now in a single lump sum |

| Optional Coverage Available | Life Insurance Coverage | Mortgage Life and Disability Insurance |

| Minimum Loan Amount | $10,000.00 | $10,000.00 |

Get started now.

All loans are subject to credit approval. Property insurance is required. Loan amounts from $10,000.00 to $500,000.00.

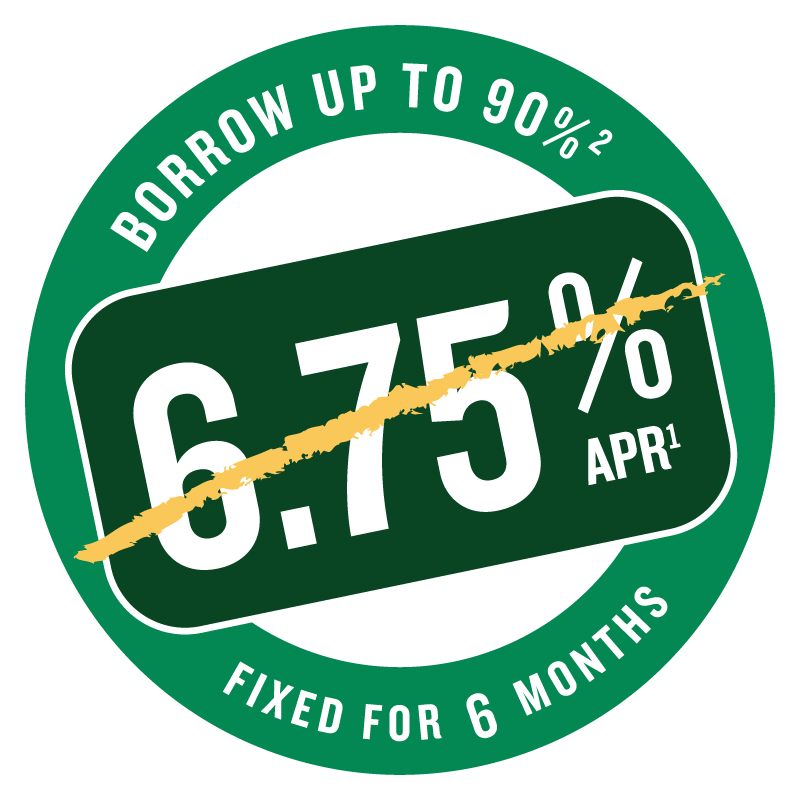

1) 4.99% Annual Percentage Rate (APR) is fixed for 6 months from closing date, at which time the APR will become variable at the Prime Lending Rate as quoted in The Wall Street Journal (currently 6.75%) plus or minus a margin based on the amount of your credit line. Rates current as of 2/11/2026. Prime is a variable rate; as it changes, the APR on your account will also change. APR will never exceed 18.00%. Stated APR is effective for line amounts between $10,000-$500,000 with an auto payment from a Katahdin Trust personal checking account. All Bank loan programs, rates, terms and conditions are subject to change at any time without notice.

2) First mortgage must be with Katahdin Trust to borrow up to 90% of home value. If not, maximum loan-to-value ratio is 80%.

3) If legal fees should exceed $125, borrower would be responsible for the portion over $125. In some cases, an appraisal is required or if you request an appraisal. Borrower is responsible for the cost, normally $775 but may be higher. An appraisal is required on all loans over $400,000. Current customers will be charged a documentation fee of 1.00% of the loan amount with a minimum fee of $250 or maximum fee of $1,500 for loans refinanced with less than $10,000 in new money.

4) Lock in your rate for a specified period with our RateLock option by converting all or a portion of the revolving balance into a fixed rate home equity loan without refinancing or reapplying, up to three separate fixed rate loans available at any one time. Minimum amount to lock in is $5,000. APR for that fixed portion will be locked until the balance is repaid and based on our current fixed home equity rates. Any line balances not converted to a fixed rate loan will continue to accrue interest at our current home equity line of credit rate. $50 fee applies for each fixed rate loan locked in.

Conforming Loan Payment Notice

All loan payments to Katahdin Trust Company must be accompanied by either an account number, payment notice or payment coupon provided. Mailed payments must be sent to Katahdin Trust Company, PO Box 36, Houlton, ME 04730. Loan payments may also be made in person to Katahdin Trust Company personnel at any of our branch locations. Payments must be received by 6:00 pm Eastern Time Monday through Friday (except bank holidays) to be credited as of that date. All other payments received will be credited as of the next business day or as otherwise permitted by law.

Please contact your local branch for details and current rate information.

Home LoansWhether you're a first-time homebuyer or you want to buy or build your next home or camp, we'd love to lend you a hand. |

Personal LoansA loan for just about anything – whether you have an unexpected expense or want to buy yourself something special, you can find a loan to fit your needs. |

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Chat with Us

Chat with Us